Hi All,

Sorry guys, I had this ready to go in preparation to add ATVI to my portfolio today, from the video summary at the bottom you will see I only found out about the deal with MSFT as I opened up the charts. With all that said, I am really disappointed. Its been 6 months of waiting and learning to let it slip in the final hours but I do think this is a good example of how the process works which is why I sent out the email. You will find the same repeatable process works with finding stocks consistently and ATVI is a great example of an undervalued stock.

Overview & Business Model

Activision Blizzard, Inc develop and distribute content and services on video game consoles, personal computers, and mobile devices.

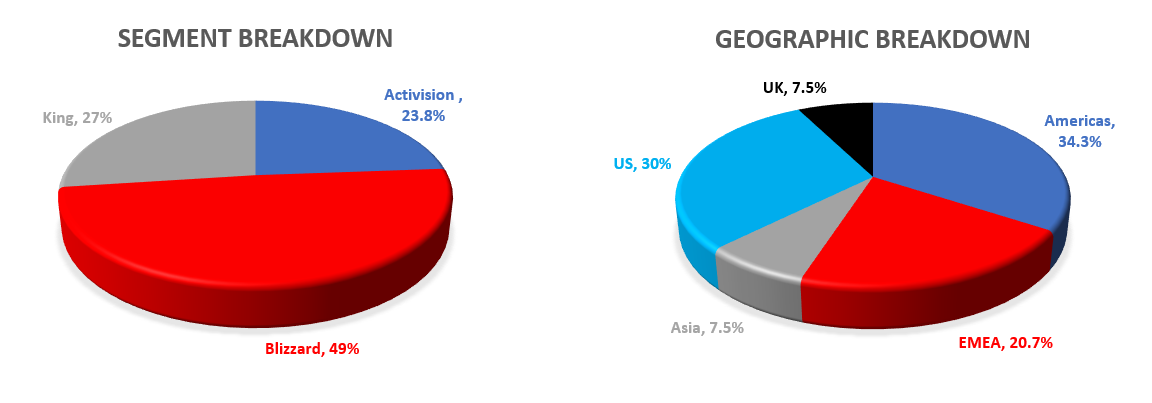

Three reportable segments:

Activision’s key product franchise is Call of Duty and also includes the activities of the Call of Duty League, a global professional esports league.

Blizzard key product franchises include World of Warcraft, Hearthstone, Diablo, Overwatch & Overwatch League, a global professional esports league.

*Monetization: premium subscription, free to play with in app purchase & licensingKing’s main franchise is Candy Crush and monetizes content via free to play with in app purchases and advertising.

Revenue breakdown:

Financials & Performance

ATVI is in a very stable financial position, boasting a cash & equivalents position of $10 billion against a long term debt pile of $3.6 billion. The net debt is -$6.4 billion which contributes in bringing down the enterprise valuation vs the market cap significantly.

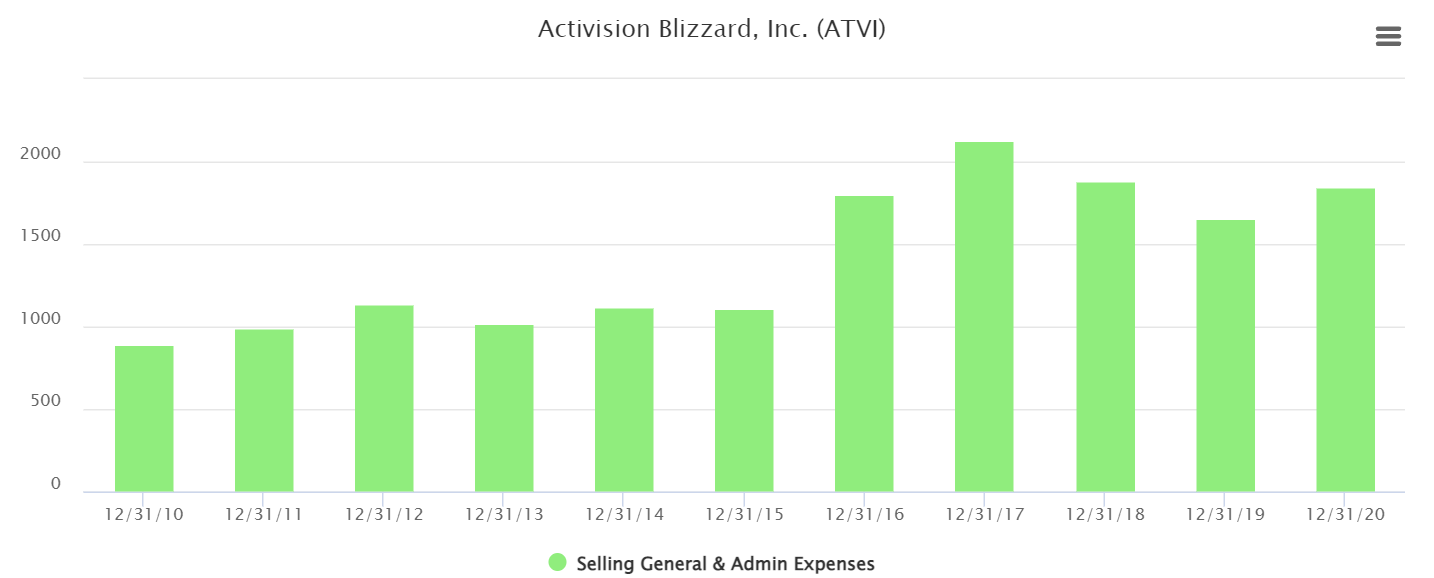

Both gross & net margins continue to grow out year on year for the past decade suggesting that ATVI has quality assets in their possession. Management have also shown through as SG&A costs as a % of revenue have declined by 8.4% since 2017.

There is some dilution due to stock based compensation, however, management have offset that dilution to some degree with share repurchases. Today, at its current valuation and in the financial position they find themselves ATVI is in a position to repurchase a meaningful amount of outstanding shares while maintaining enough capital for R&D/CAPEX and strategic M&A (in light of TTWO deal to buy ZNGA).

Concerns:

My initial concerns were centered around the long term engagement users might have from Candy Crush which is a significant portion of their revenue. That being said, these are my opinions and its important to note that the performance of Candy Crush continues to show very strong performance.

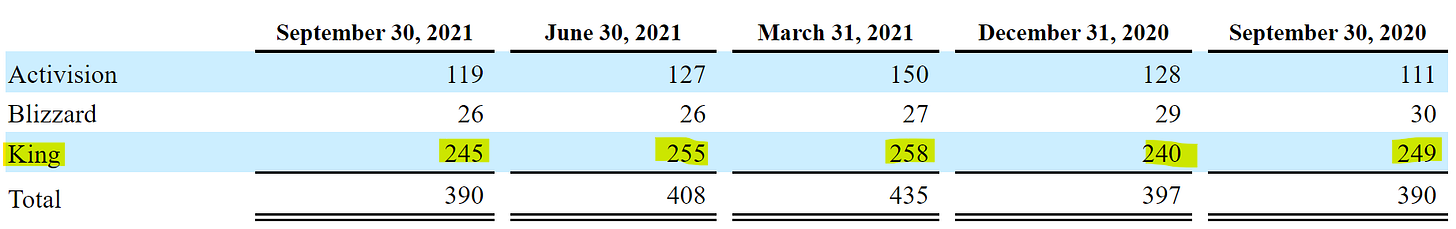

The following table details revenue for King Digital on a quarterly basis:

The following table details average MAUs on a sequential quarterly basis (millions):Over the past number of months there has been a lot of focus on a toxic workplace environment at ATVI with accusations of gross misconduct. This has to some degree led to a >40% decline in the stock. As of this morning Reuters reports that the company has fired 3 dozen staff members and disciplined at least 40 related to this. It would seem from the outset that the company are taking significant steps to right past wrongs. The share price today remains negatively impacted offing investors an opportunity to invest if the company is successful with their efforts.

Valuations & Expectations

There are a couple of variables to consider in order to determine what a fair multiple the market is willing to pay for ATVI.

Revenue growth

Quality of earnings

Market tailwinds

Revenue Growth:

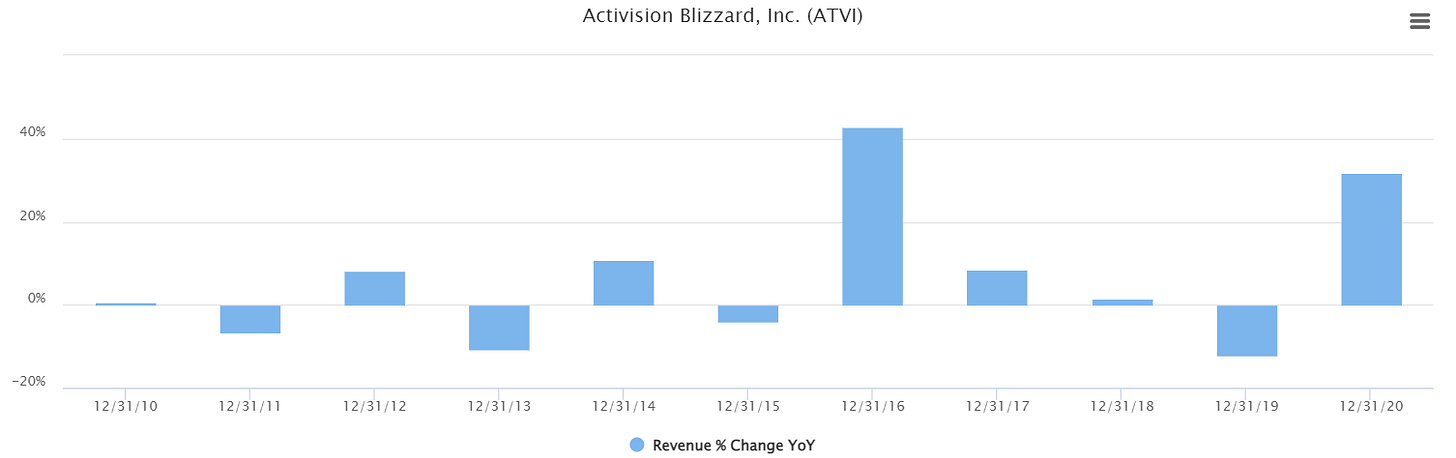

Revenue growth over the past decade has been spotty with a CAGR of 5.8%, the forecast revenue over the coming 5 years is anticipated to come in at 9.9% largely driven tailwinds and trends that emerged post Covid.

Over the past decade the market has paid just shy of 21x price-to-earnings and roughly 13.5x enterprise-to-EBITDA. With forward revenue growth expected to outperform the past 10 years CAGR these multiples could be a fair referencing point.

Quality of Earnings

A major inflection point hit in 2016/17 for the company. SG&A cost began to reverse as revenue was expanding. this shows us the management are efficient and very much savvy with spending to grow.

This led to huge expansion in gross margins while SG&A margins took a dive.

The quality of earnings over the past 5 years has improved significantly and despite the slower top line growth there is more revenue flowing to the bottom line over time which leads me to the conclusion that the market will continue to pay a premium for the company today.

Market Tailwinds

Analysts are forecasting ATVI to grow at a CAGR of 9.9% over the coming 5 years while Statista forecast 7.24% CAGR over the same period. I do think its reasonable that a leader within the space continues to command a higher growth rate vs the market and therefore believe estimates are somewhat reasonable.

Valuation expectations

ATVI is forecast to reach net income of $5.081 billion by 2025. If we are to assume the analyst estimates are somewhat reasonable and the historic multiple as pointed out above at 21x is fair, we can assume a target market cap of $106.7 billion offering up roughly 113% total return ex-dividend or 20.31% CAGR which falls above our hurdle rate of 20% annualized.

How does the company get there and what are the odds? Its important to remind ourselves of the net debt and how that can be utilized to repurchase shares today bringing down the outstanding share count and the valuation in tandem. With a share repurchase program at todays price the company can afford to miss on the guided 9.9% from analysts and still fall within our range.

I believe ATVI to be a great long term play at current prices based on all of the above and I do anticipate price to outperform over the specified timeframe we have laid out. Should price get ahead of itself during any given year, utilizing rebalancing techniques can also maximize your long term returns and something to consider.

OMG ROB i started laughing my ass off, the moment you realized it got acquired while quite frustrating, was hilarious. More opportunities to come, cheers.

yea thanks for posting it anyway... we're with you!