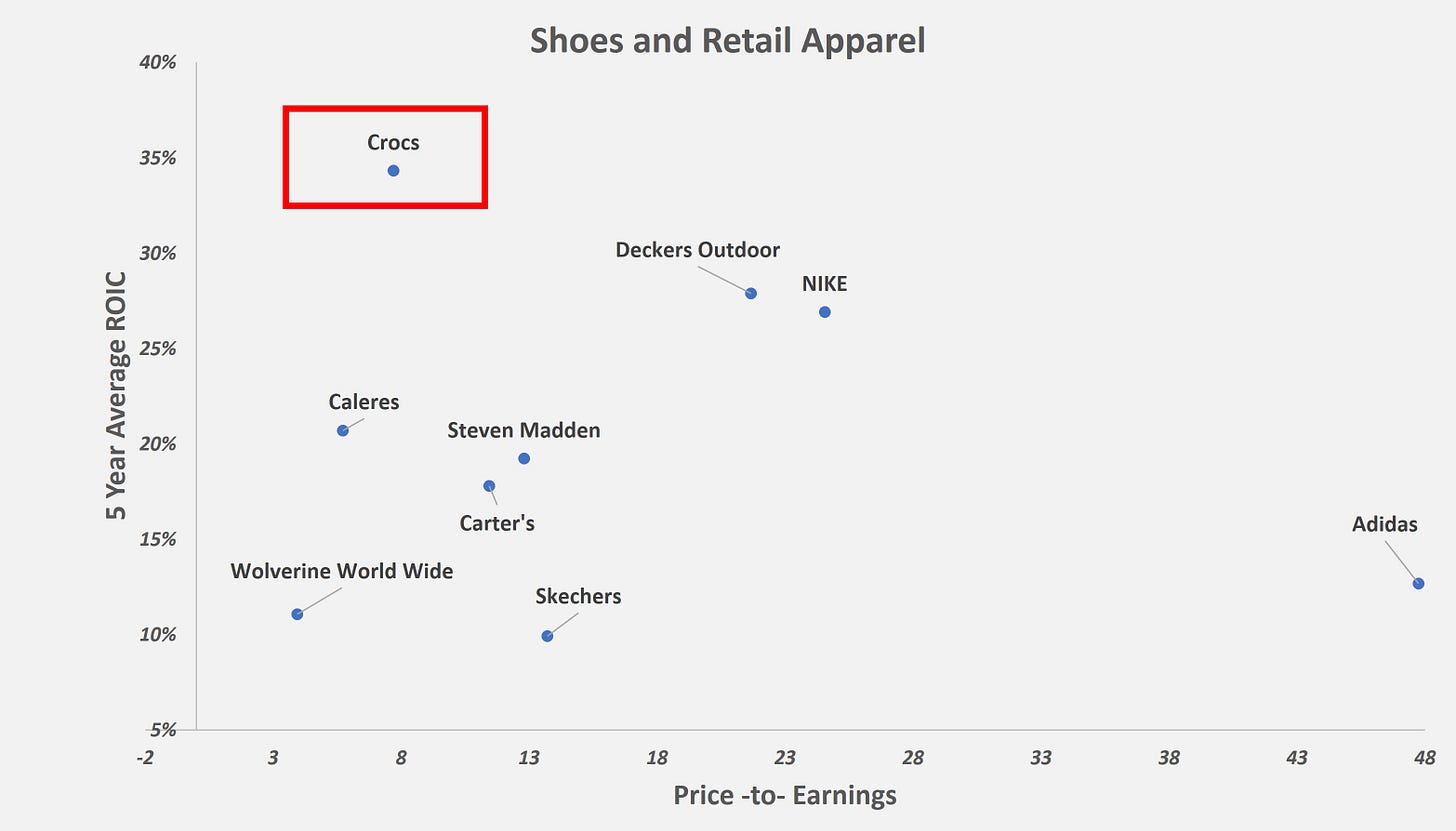

Despite incredible efficiency, strong revenue growth and the highest rates of return within the “Shores & Retail Apparel” market, Crocs has persistently been met with scepticism regarding whether the increased demand for their clogs and now casual shoes from HEYDUDE is a fad.

Fad’s typically last one season before fizzling out, we believe that these brands are built on a solid foundation with a loyal customer base that has supported revenue growth year on year for the past decade as earnings grew at a 35% CAGR.

This view was further supported by comments from Anne Melhman, Crocs CFO, who mentioned “we gained significant market share in a declining U.S. footwear market” on the latest quarter.

Table of Contents:

Business Model, Competitive Advantages & Growth

Market Concerns Post Earnings

Financials

Capital Allocation Strategy

Valuation & Expectations

Keep reading with a 7-day free trial

Subscribe to The Bottom-Up Bulletin to keep reading this post and get 7 days of free access to the full post archives.