Two guarantee’s in life - taxes and death.

H&R Block offer small businesses and individuals tax assisted services that generate significant cash flows that are very consistent long term. What they do with that cash determines whether the shareholder value of the company increases over time to make an acceptable return.

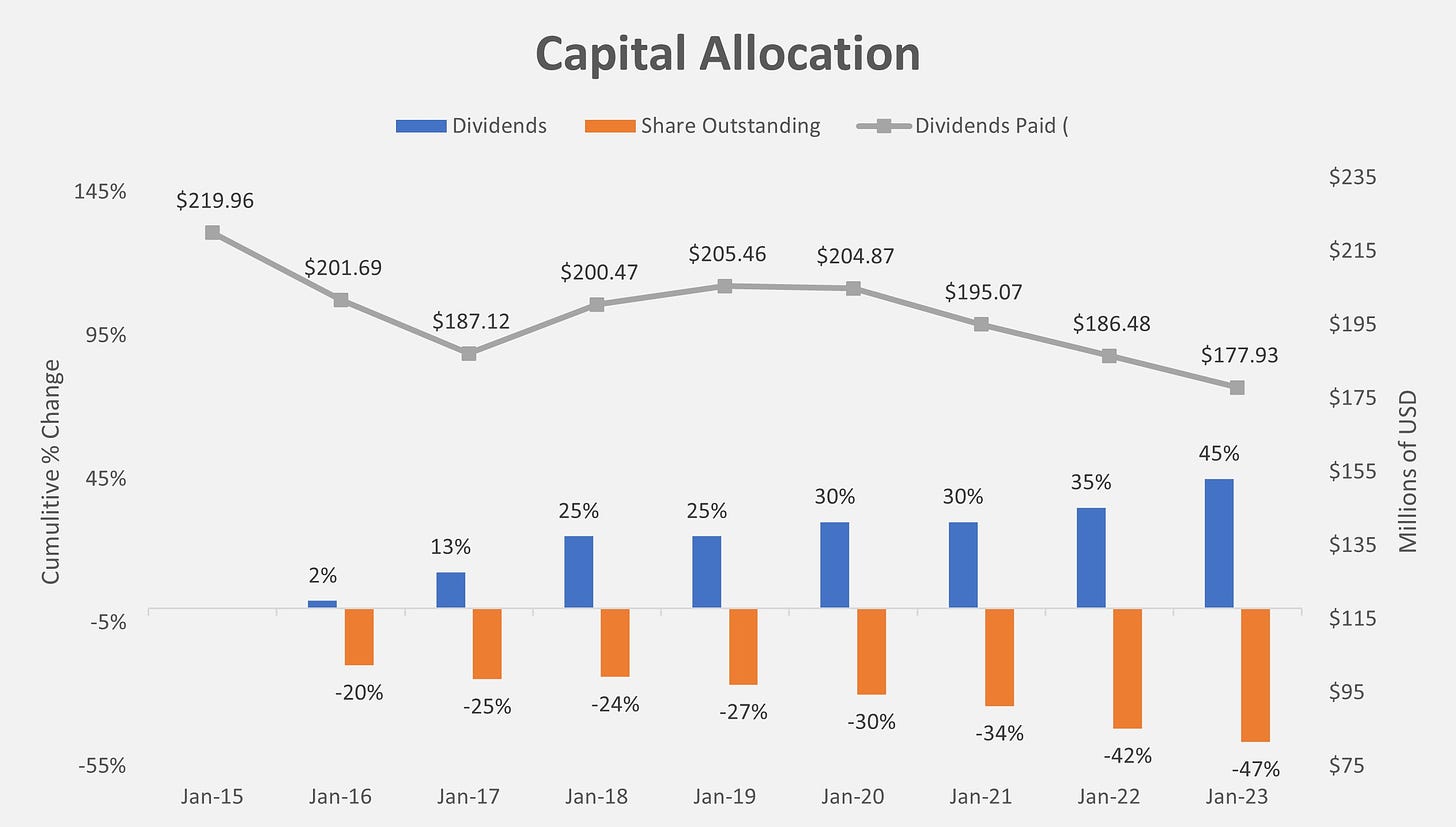

Since H&R Block moved away from banking services in 2015 the number of outstanding shares has decreased 47% while the dividend per share increased 45%. What makes this business so exciting is the capital allocation flywheel that allowed this to happen while dividend expense dropped 19%.

Table of Contents:

Business Model, Sticky Services & the Flywheel

Implications of P&A transaction

Capital Allocation Strategy

Financials

Valuation & Expectations

Keep reading with a 7-day free trial

Subscribe to The Bottom-Up Bulletin to keep reading this post and get 7 days of free access to the full post archives.