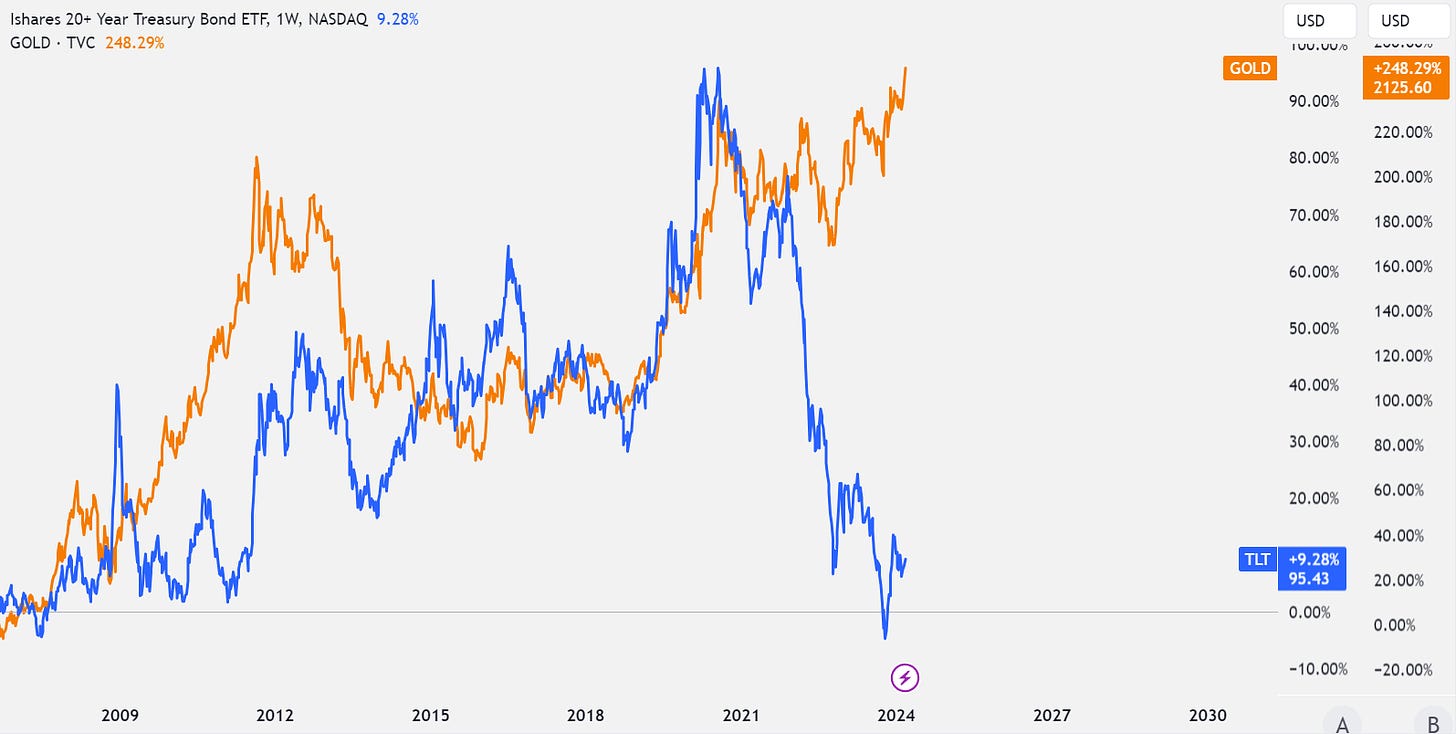

An interesting change is occurring from a macro perspective over the prior two years. As US government deficits continue to expand Gold and treasuries have diverged significantly. This is not a subtle change given that treasuries have been considered “pristine collateral” used to underwrite the financial system (Bretton Woods, 1944).

Today, Gold looks to be replacing treasuries as collateral with benign foreign demand for US government debt.

Over the past year miners have also diverged significantly from the underlying commodity prompting the CEO of Newmont to call this a 'Once-in-a-generation buy' during an interview on Bloomberg back in late February.

Contents:

Are we moving into a Golden era for Gold?

Further support for a momentum breakout in the Gold price

Napkin math

The capital allocation strategy is quite simple

Assets & Debt maturities

Final Thoughts

Listen to this episode with a 7-day free trial

Subscribe to The Bottom-Up Bulletin to listen to this post and get 7 days of free access to the full post archives.